ARTICLE SUMMARY:

Medtech manufacturers have been talking about the transition to value-based care for much of the past decade, and it remains a widely discussed topic among executives. Yet, despite all of these conversations, the stacks of white papers, and countless conference sessions, VBC contracts in medtech remain largely stuck in the mud, even as they gain traction in broader health sector. By Jay Zhu and Adam Lowry, Deloitte LLP.

Deloitte Life Sciences

Comprehensive consulting, financial advisory, risk management, audit, tax and related capabilities, along with software products and platforms, deliver value at every step - from insight to strategy to action.

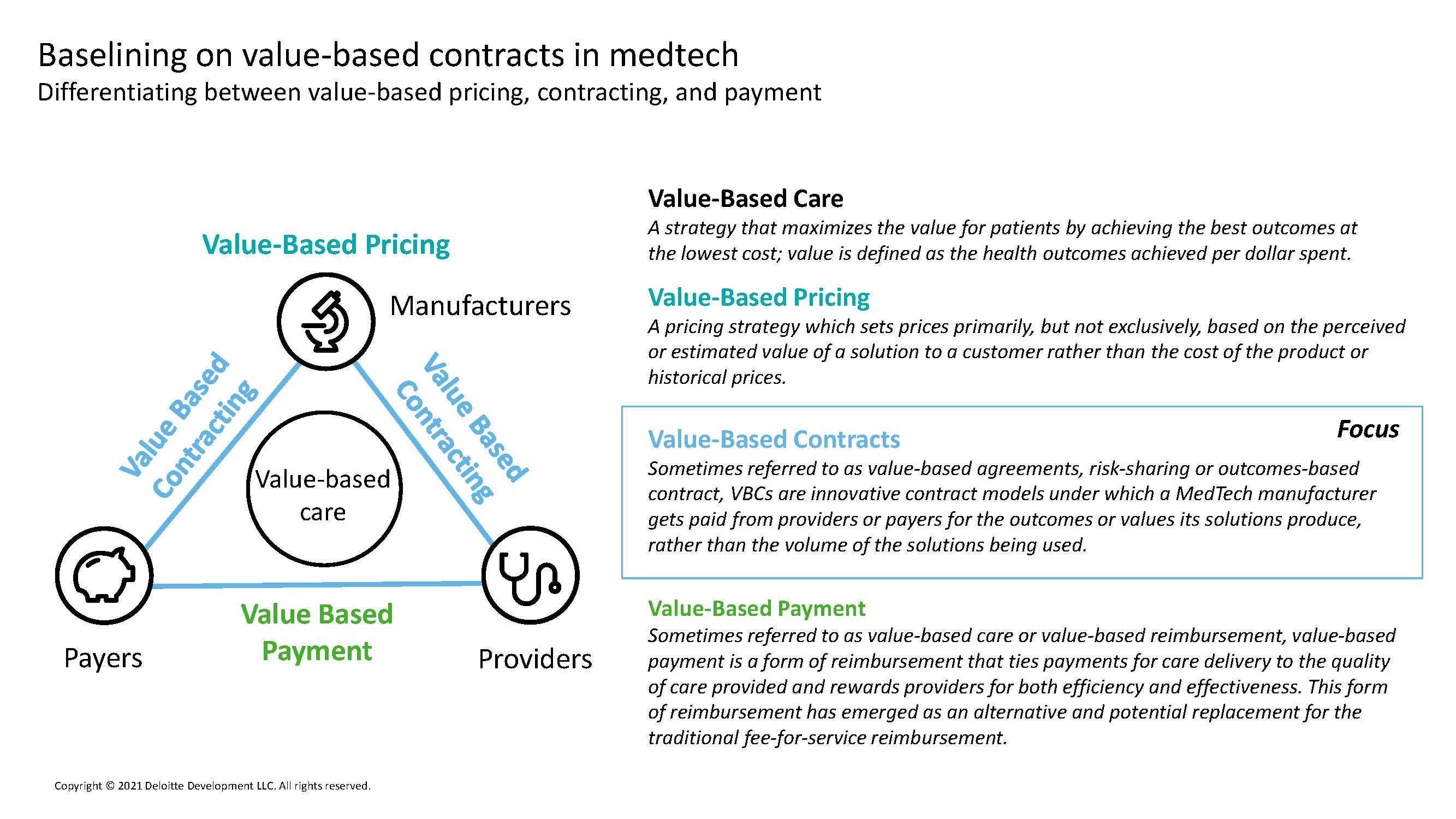

The accelerating adoption of value-based contracts (VBC) in health care appears to be driven by several trends, including unsustainable cost growth, fee-for-service (FFS) revenue declines during the COVID-19 pandemic, and an increased focus on health equity. Many healthcare delivery systems have doubled down on VBC—and on population-health strategies—and are forming strategic relationships with their payor partners.

While the COVID-19 pandemic altered the way manufacturers go to market, adoption of value-based contracts is not growing at the same rate as the broader industry. For some hospitals and health systems, testing and treating COVID-19 left little time for negotiating, contracting, and reporting quality measures, which are essential for manufacturer value-based contracts. There appears to be a consensus in the medtech sector that you never want to run faster than your customers. If hospital and health systems aren’t demanding these arrangements, medtech companies aren’t likely to push for them.

However, many healthcare providers are facing what could be an unsustainable financial position, and they see value-based contracts with health plans as a potential lever to change the status quo. Close to 60% of health plan and health system financial executives say moving to new payment models over the next three years is a top priority, according to a recent survey conducted by the Deloitte Center for Health Solutions. Several factors are pushing health plans and health systems toward VBC. They include:

- Declining FFS rates and a changing payor mix are creating margin pressure for hospital-centric systems.

- Long-term financial success is dependent on an ability to grow market share and create stickiness with patients.

- Payors and regulators are exerting pressure on cost through VBC contracts and utilization management.

- New care-delivery models that focus on wellness require new payment models to fund required investments in capabilities.

- Care has become unaffordable and inaccessible in some communities, which can exacerbate health-equity challenges.

- Competitors can create price-erosion pressure by offering lower prices for similar products.

As more health plans and providers enter in to VBCs, they have more of an incentive to expand such arrangements to device manufacturers because it can help further control costs.

VBC Contracts Won’t Work for All Devices

VBC shifts the conversation from a device to an outcome. VBC contracts make the most sense for medical devices that have a direct impact on patient outcomes and where the value might not be easy to quantify. If the value of a medical device is obvious for a medtech product, that value is typically built into the price. However, if the value of a device isn’t clear, the health system might want a discount to help counter the risk if the device doesn’t produce the expected outcomes. However, getting access to performance data for a device can be a significant hurdle for manufactures if the information is generated by healthcare providers. Manufacturers might need to conduct clinical studies to generate their own data.

Another challenge that has hindered adoption of VBC contracts in medtech might be linked to regulations. AdvaMed has been working with federal agencies to rethink some of these rules, particularly safe-harbor regulations and the anti-kickback statute. The statute makes it illegal to receive anything of value to induce or reward the referral of federal health care contracts. It was created in an FFS environment but could pose barriers for medtech companies that try to enter into alternative payment arrangements.

VBC Can Be a Win-Win-Win-Win

Under an FFS payment model, discounts for medical devices are typically tied to volume. In a VBC arrangement, prices are tied to performance and/or patient outcomes. While VBC contracts are based on the sharing of risk, that doesn’t mean that one group needs to lose for another to win. If done correctly, these contracts can benefit the manufacturer, the payer, the health system, and (most importantly) the patient. Consider this: A medtech company develops a product that reduces infection risk among patients who have a device implanted. Despite the benefit, the new product likely won’t be covered by the health plan, which means the health system has little incentive to buy it. However, if the manufacturer can demonstrate a reduction in infections, it might offer a performance guarantee in the form of a VBC contract. The manufacturer, for example, might cover additional costs tied to unexpected infections.

It has been about a year since we teamed up with AdvaMed and several medtech companies to create a value-based care working group that we hope might be able to move the conversation into action. The AdvaMed Commercial Forum launched in early 2021 with the goal of increasing medtech participation in outcomes-based payment arrangements. We will discuss some of the progress we’ve made with this group at AdvaMed’s annual conference later this month.

Jay Zhu is a Managing Director and Adam Lowry is a Senior Manager at Deloitte LLP.

Jay Zhu is a Managing Director and Adam Lowry is a Senior Manager at Deloitte LLP.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the “Deloitte” name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.

This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication.

Copyright © 2021 Deloitte Development LLC. All rights reserved

Comprehensive consulting, financial advisory, risk management, audit, tax and related capabilities, along with software products and platforms, deliver value at every step - from insight to strategy to action.

Learn more at Deloitte Life Sciences