ARTICLE SUMMARY:

Excerpts from the latest coronavirus analysis in MedTech Strategist, Market Pathways, and the Community Blog. Our coronavirus coverage is free to all—click the links to read full articles.

The Other Side with David Filmore

In this video interview, Market Pathways Executive Editor David Filmore and The Other Side host Joe Mullings discuss the regulatory implications of COVID-19 for the global medtech industry. They cover FDA’s efforts to employ “maximum flexibility” in expediting policies during the pandemic, while trying to cause no harm, the pandemic’s long-term effect on global harmonization efforts, the potential delay in EU MDR implementation, and more.

In this video interview, Market Pathways Executive Editor David Filmore and The Other Side host Joe Mullings discuss the regulatory implications of COVID-19 for the global medtech industry. They cover FDA’s efforts to employ “maximum flexibility” in expediting policies during the pandemic, while trying to cause no harm, the pandemic’s long-term effect on global harmonization efforts, the potential delay in EU MDR implementation, and more.

Posted on the Community Blog April 3, 2020

COVID 19: On the Primary Care Frontlines

As the COVID-19 pandemic makes its way across the US, primary care providers are finding themselves on the frontlines of patient screening, monitoring, and education efforts. Many are reaching out to telemedicine providers to help manage their growing caseloads and provide a remote care alternative that can help dampen the spread of this disease.

One primary care provider already well positioned to deal with the crisis is Forward, which has a tech-heavy, subscription-based primary care model—with offices in several large US cities—designed to offer a more modern, patient-friendly primary care experience. Forward built its care model on a digital health platform that includes, as part of its offerings, an app that provides members with 24/7 remote access to the Forward care team.

One primary care provider already well positioned to deal with the crisis is Forward, which has a tech-heavy, subscription-based primary care model—with offices in several large US cities—designed to offer a more modern, patient-friendly primary care experience. Forward built its care model on a digital health platform that includes, as part of its offerings, an app that provides members with 24/7 remote access to the Forward care team.

But, as well positioned (technology-wise) as it might have been prior to the crisis, the coronavirus pandemic has prompted the company to rapidly adapt and further bolster its remote care offerings. Forward recently added a COVID-19 screening tool to its app, and it also launched a new program called Forward At Home, which combines unlimited telemedicine consultations with interactive health data visualization and at-home vital signs monitoring. Forward also recently rolled out a rapid serological blood test for its members, purchased from diagnostics companies, that it is using in conjunction with PCR-based COVID-19 screening tests at its clinics and drive-through sites nationwide.

We speak with Nate Favini, MD, Medical Lead at Forward, who discusses the steps Forward is taking to deal with the crisis and the impact the pandemic is having on both providers and patients. According to Favini, the growing number of COVID-19 cases is “overwhelming” the healthcare system and telehealth is more essential than ever to meeting people’s healthcare needs.

Posted on MedTech Strategist April 6, 2020

CMS and HHS Ease Restrictions on Telemedicine During COVID-19 Pandemic

In response to the COVID-19 health crisis, CMS has temporarily relaxed long-standing restrictions on the use of telemedicine for Medicare beneficiaries, creating a pivotal moment for the telemedicine and remote care industries. Demand for telehealth services in the US has already risen substantially over the past several weeks, and the moves by CMS and other government agencies will add to that momentum. Depending on how smoothly the ramp-up goes, it is quite likely that some of these  temporary policy changes may become permanent once the pandemic is over. But the biggest recent boost for telemedicine came in mid-March when CMS announced it was easing restrictions on telehealth for Medicare fee-for-service (FFS) patients, a move taken in response to the COVID-19 epidemic but one that many in the industry say was long overdue. Many private insurers also weighed in, waiving deductibles for telehealth visits to aid social distancing efforts and help slow the rapid growth of COVID-19 cases.

temporary policy changes may become permanent once the pandemic is over. But the biggest recent boost for telemedicine came in mid-March when CMS announced it was easing restrictions on telehealth for Medicare fee-for-service (FFS) patients, a move taken in response to the COVID-19 epidemic but one that many in the industry say was long overdue. Many private insurers also weighed in, waiving deductibles for telehealth visits to aid social distancing efforts and help slow the rapid growth of COVID-19 cases.

We discuss these developments, and the long-term implications, in our Q&A with Kevin Harper, Policy Director for the American Telemedicine Association. According to Harper, by easing Medicare coverage restrictions, CMS paved the way for a huge underserved population to receive remote care, a surge that will take the telemedicine industry into “uncharted waters.” Government regulators will be watching closely in the coming months, he says, to see what works and what doesn’t, and to determine if some of these policy changes should be made permanent.

Posted on Market Pathways, April 6, 2020

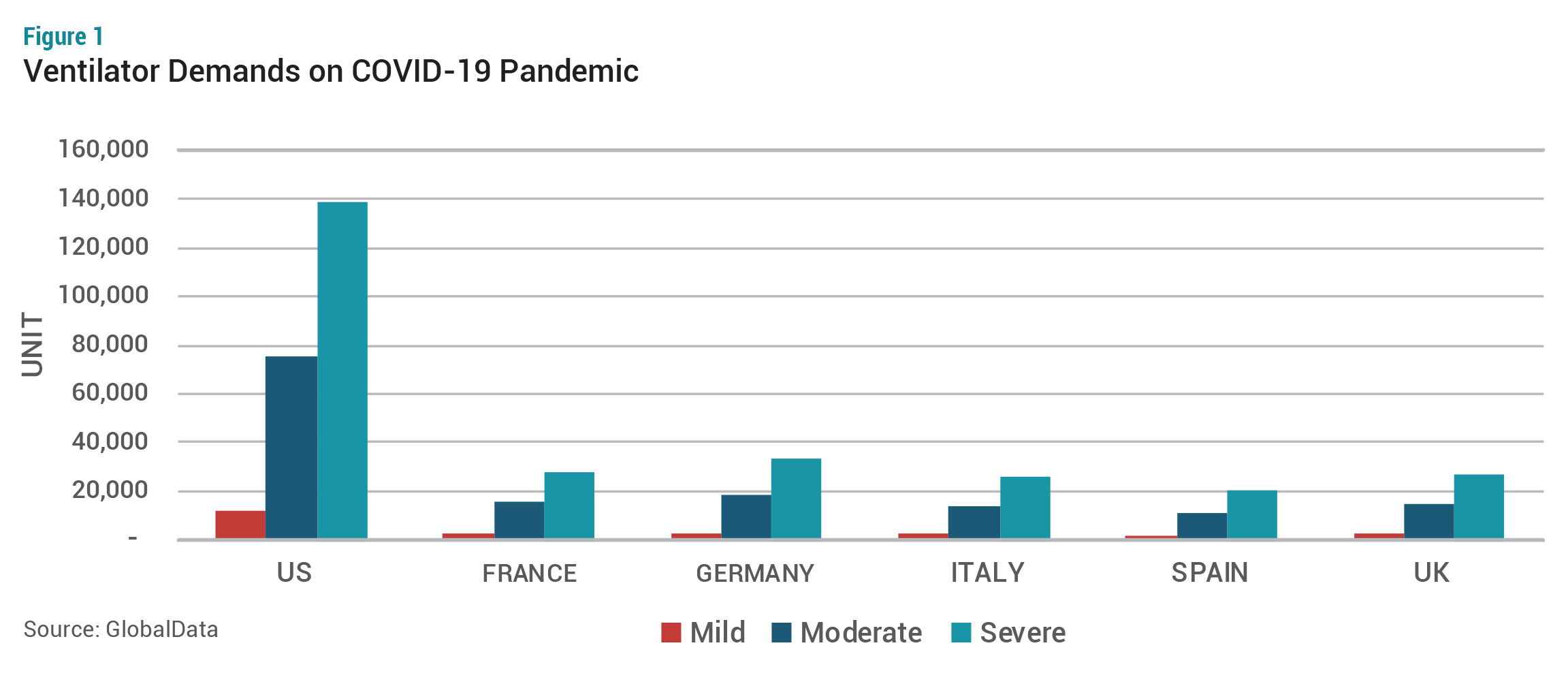

Can Government and Private COVID-19 Initiatives Meet Global Ventilator Demand?

COVID-19 has highlighted just how completely under-prepared global healthcare systems are for large public health crises and how stressed are the critical care and protective medical equipment supply chains. The category of devices most in the spotlight certainly has been respiratory ventilators, which for a variety of reasons are in very short supply. As the US and other governments look for ways to ramp up supplies, it is not at all clear how easily this can be done, or whether it will translate into commercial opportunities for traditional manufacturers, many of which were already producing ventilators and protective medical gear at full capacity.

To better evaluate global capabilities and options for expanding ventilator supply, it is worthwhile to step back and outline the status of the sector prior to COVID-19. To do this, MedTech Strategist discussed the situation with GlobalData medical device analysts Andrew S. Thompson, PhD, director of therapy research and analysis, medical devices, and Tina Deng, senior analyst, medical devices. They provided pre-COVID-19 data on ventilator demand, as well as crude estimates of how COVID-19 is likely to shift those numbers.

To better evaluate global capabilities and options for expanding ventilator supply, it is worthwhile to step back and outline the status of the sector prior to COVID-19. To do this, MedTech Strategist discussed the situation with GlobalData medical device analysts Andrew S. Thompson, PhD, director of therapy research and analysis, medical devices, and Tina Deng, senior analyst, medical devices. They provided pre-COVID-19 data on ventilator demand, as well as crude estimates of how COVID-19 is likely to shift those numbers.

Prior to the COVID-19 outbreak, GlobalData valued the global respiratory ventilator market at $1.4 billion in 2019, or 74,606 units, including both critical care and transport equipment. The compounded annual growth rate (CAGR) was steady at 4%, driven by an aging population, an increasing number of intensive care unit admissions, and expanding demand for respiratory devices in emerging countries.

To meet the COVID-19 demand, traditional ventilator manufacturers estimate that they could double capacity, although it’s not clear how rapidly. To do this, they need to hire staff and expand assembly lines (though this is restricted by the availability of clean rooms). They may also face supply limits of complex parts. The “emergency” ventilators made by car makers and other, non-traditional manufacturers will have to meet a minimally acceptable standard and likely after COVID-19 subsides, they will be scrapped.

Posted on MedTech Strategist, April 3, 2020

![]() Trial MyStrategist.com and unlock 7-days of exclusive subscriber-only access to the medical device industry's most trusted strategic publications: MedTech Strategist & Market Pathways. For more information on our demographics and current readership click here.

Trial MyStrategist.com and unlock 7-days of exclusive subscriber-only access to the medical device industry's most trusted strategic publications: MedTech Strategist & Market Pathways. For more information on our demographics and current readership click here.