ARTICLE SUMMARY:

The IVD industry’s robust growth reflects its technological and geographic diversity, but doesn’t account for some of the disruptive forces pulling on its traditional business model.

Far-ranging strategic questions swirl around the in vitro diagnostics (IVD) industry these days. How the intersection of Big Data, value-based healthcare, and pricing pressures will all play out is an open question and was an underlying theme of discussion at the annual meeting of the American Association for Clinical Chemistry, held in early August in Chicago.

But any good assessment starts with the business fundamentals, which were outlined, from the manufacturers’ perspective, in a meaty presentation by IQVIA on August 1 at the AACC’s traditional financial/ international markets briefing. The session went much further, and we’ll have more to say on it in the upcoming issue of MedTech Strategist, but the data presented by Greg Stutman, Director of Global Solutions, Diagnostics, at Boston Biomedical Consultants, an IQVIA division, set a good stage.

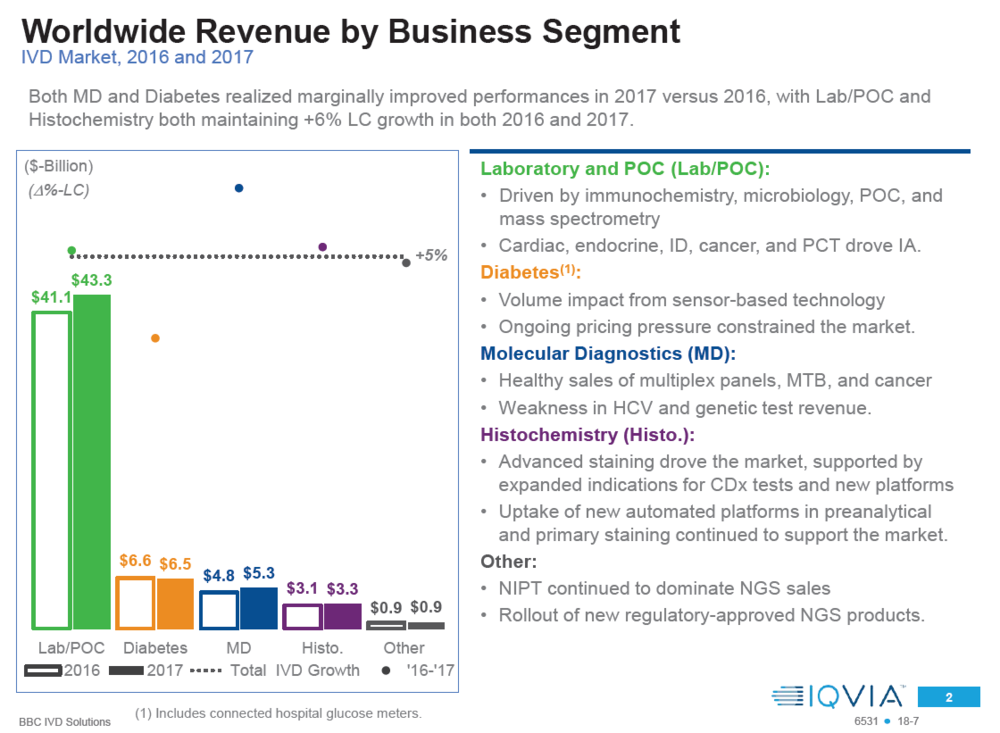

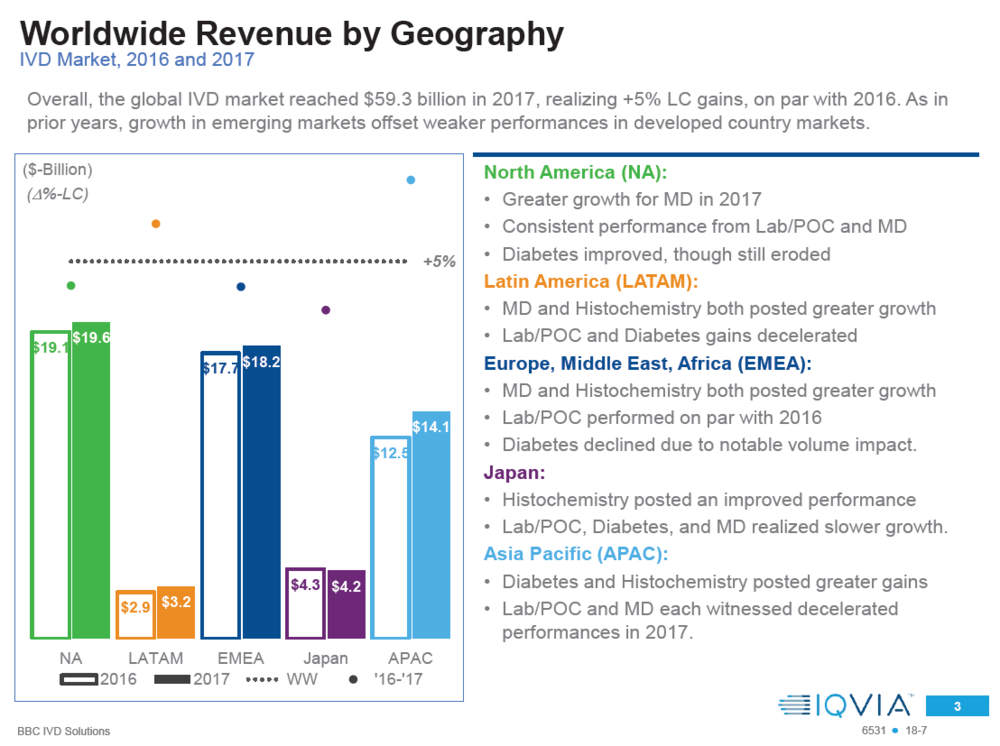

First cornerstone: The global $60 billion IVD market—defined as net revenues to manufacturer—is healthy, and growing at a 5% clip, putting it squarely in the middle of the industry’s general track record of 4% to 6% growth rate (see Figure 1.) Despite volatility in certain sectors, and tremendous competitive pressures, the industry’s technological and regional breadth enables it to maintain this even keel, Stutman noted.

The year 2017 was a case in point. Broken down by technology sector, the biggest segments of the industry by far—laboratory and point of care testing (POCT)— grew year on year on par with the overall trend, at 5%. Within that category, however, sits a very heterogenous group of product offerings that have their own trajectories. The emergence of higher-sensitivity troponin tests in cardiac care, procalcitonin (PCT), and some other assays boosted sales of immunochemistry. Microbiology, mass spectrometry, hematology, hemostasis, and a host of POCT areas also grew, but some of their gains were offset by the mature, commoditized dynamics of clinical chemistry.

In immunochemistry, one of the biggest subsectors, oncology and endocrine testing are thriving, but most of that gain is in emerging markets, where the healthcare infrastructure is expanding and basic test volume is increasing. Hematology is still a “capital friendly environment” and hemostasis (coagulation) is healthy, Stutman said. POCT, a vast subsegment, has prospered due to demand for immunoassay tests, HA1C, and a “really big year” for rapid testing due to last winter’s heavy flu season.

In contrast, diabetes, once a huge driver for the industry, lagged. Population and disease demographics are favorable, but the challenges of reimbursement, commodization, and general lack of awareness and education are barriers, Stutman said. Within this ailing segment, however, is a “truly revolutionary” bright spot: sensor-based technologies, of which Abbott Laboratories Inc.’s Freestyle Libre system is an example. When it was introduced last year in France, demand for whole glucose strips quickly dropped by 20%, Stutman noted. “This is diabetes management, but it shows the impact that this new technology is having on IVD, and Abbott is enjoying the ride, especially as more countries adopt sensor-based technology.”

In molecular diagnostics, one of the most innovation-driven areas of the IVD world, blood bank screening is mature, but infectious disease testing is faring well, with sales of multiplex panels tied to demand for respiratory tests. Also attractive are tuberculosis and oncology tests; weaknesses were in HCV testing, where the number of new patients entering therapy is slowing, and genetic testing revenues, which were hurt, one assumes—since Stutman didn’t elaborate—by reimbursement challenges.

Finally, histopathology, the last big subsector, is seeing growth in advanced staining (immunoassays and in situ hybridization), with a big focus on oncology testing and companion diagnostics. The primary staining market is also attractive (this involves instrumentation and H&E cover slips).

Cornerstone 2: On a regional basis, the US has undergone major changes in the last 10 years, affected by the global financial crisis, then the Affordable Care Act (emphasis on wellness and primary care) and now the Trump Administration. The overall US market is still on a positive trajectory and adopting new technologies at a faster pace than elsewhere, Stutman said, even as it is reeling from the extremely controversial (pre-Trump) PAMA (Protecting Access to Medicare Act) and clinical laboratory fee schedule reforms.

That said, Latin America and Asia-Pacific are the global industry’s engines “of growth in the future” despite reimbursement and regulatory reforms in those regions and an economic slowdown in China and volatility in South America. While their growth is now about average, “as these pieces of the pie increase, they will exert more influence on the global pie,” he said (see Figure 2).

Emerging market growth makes up for some of US maturity shortfall, but it does not take into account entry of new players and disrupters from the well-financed tech world. Big strategic questions swirl around the in vitro diagnostics industry these days, particularly in Western countries: How can laboratories—be they independent reference labs, esoteric labs, or hospital-based labs—extract more value in an era that is uncommonly frustrating for their business models? The industry is rife with innovation and it is basking in the high profile of the data it produces, which puts it at ground zero for all kinds of data-driven health initiatives. Yet many of its largest subsegments face unrelenting, unprecedented pricing pressure and reimbursement and investment gaps, as well as an influx of new kinds of potentially disruptive competitors with deep pockets and plenty of gumption. How that will play out should be fascinating and lead to groups of winners and losers.

#CommunityBlog #MedTechStrategist #medicaldevice #medtech #wendydiller #strategy #invitro #emergingmarkets #ontheroad #IVD #invitrodiagnostics #immunochemistry

![]() Trial MyStrategist.com and unlock 7-days of exclusive subscriber-only access to the medical device industry's most trusted strategic publications: MedTech Strategist & Market Pathways. For more information on our demographics and current readership click here.

Trial MyStrategist.com and unlock 7-days of exclusive subscriber-only access to the medical device industry's most trusted strategic publications: MedTech Strategist & Market Pathways. For more information on our demographics and current readership click here.