ARTICLE SUMMARY:

With the insulin patch pump market thriving, the number and variety of tubed automated insulin delivery systems is expanding as well, and tubed competitors are now keenly focused on usability. Excerpted from our recent feature article.

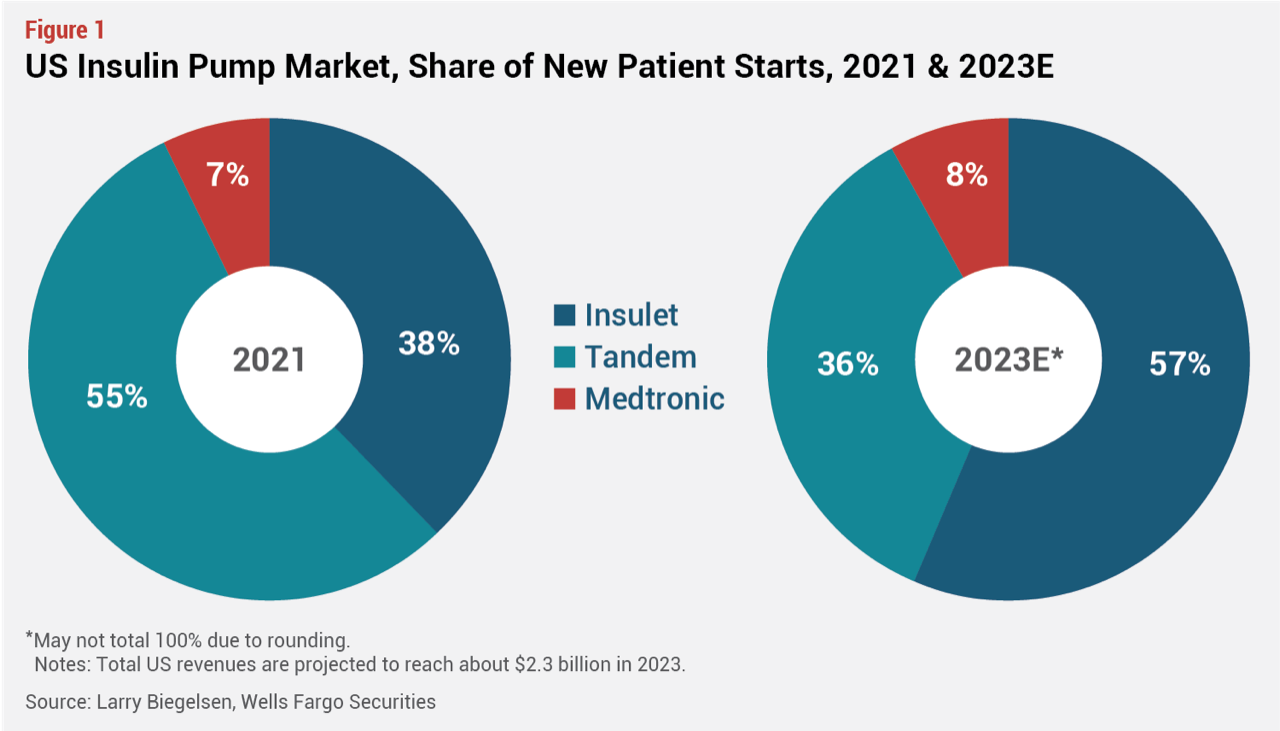

According to Larry Biegelsen, an analyst with Wells Fargo Securities, the insulin pump market is valued at about $2.3 billion in the US and is growing in the low teens (about 14% CAGR, 2020-25). Insulet’s performance has improved steadily since the Omnipod 5 launch, and the company now holds more than 50% revenue share in the US. Much of that gain is coming from new pump users, with Insulet now capturing about 57% of new pumpers in the US, a gain of 19 percentage points since 2021,  and mostly at the expense of Tandem Diabetes Care (see Figure 1). Competitive conversions also remain strong but have eased off somewhat from the initial launch last year, with 30% of new Omnipod 5 users in Q1 ’23 switching from a competitor pump, according to Insulet

and mostly at the expense of Tandem Diabetes Care (see Figure 1). Competitive conversions also remain strong but have eased off somewhat from the initial launch last year, with 30% of new Omnipod 5 users in Q1 ’23 switching from a competitor pump, according to Insulet

Medtronic’s latest tubed AID offering is the MiniMed 780G AID system, FDA approved in April of this year (following resolution of FDA’s warning letter) for T1s age seven and up. With the 780G, Medtronic has basically overhauled its AID algorithms, adding a unique Meal Detection technology that senses if the user has undercounted the carbs they consumed or has forgotten to bolus after a meal and automatically delivers bolus correction doses every five minutes. This technology is expected to resonate particularly well with people who have difficulty counting carbs, but missed and late boluses are common, so it could have wide appeal among AID users. In addition to addressing the burden of carb counting, the system also eliminates required fingersticks, reduces infusion set changes (it has the only seven-day wear infusion set), and incorporates fewer alerts and steps. And it is the only AID to offer flexible glucose targets down to 100 mg/dL.

Meanwhile, Tandem has several upcoming milestones that it believes will help boost its AID business. The company is likely to be the first (ahead of Insulet) to offer an AID integrated with Dexcom’s new G7 CGM and Abbott’s FreeStyle Libre CGMs—it plans to have both widely available in the US later this year (its AID is currently integrated with the G6) and expects to experience a growth uptick as a result.

Moreover, Tandem recently received FDA clearance for its new, compact Mobi AID, which doesn’t have an on-pump screen and is about half the size of its existing t:slim X2 pump. In addition to its smaller form factor, Mobi is less expensive to manufacture, and it offers full mobile device control, including a mobile bolus option. Tandem is touting the device, cleared for T1s age six and up, as “the world’s smallest” durable AID, and it believes Mobi may appeal to both T1 and T2s on intensive insulin therapy (Tandem is pursuing a type 2 indication for its Control-IQ AID algorithm, with a pivotal study commencing this year). The company is planning a limited US release of Mobi later this year, with full release in early 2024, and expects Mobi to help it recapture some ground in new patient starts and boost revenue growth.

That boost could be substantial if Tandem is able to sell Mobi through the US pharmacy channel, as it eventually hopes to do. But Tandem is considering alternate reimbursement mechanisms for Mobi as well, he said, including the possibility of a monthly payment plan. Monthly payment/subscription plans help alleviate up-front costs and are being discussed more frequently these days in the diabetes device arena, as forward thinkers such as Bigfoot Biomedical and others pave the way.

As it works to develop the Sigi patch pump over the next several years, Tandem is also seeking earlier entry into the tubeless pump segment by leveraging an upcoming tubeless version of Mobi. That system, which could launch around 2025, will allow users to choose tubed or tubeless insulin delivery, or switch between the two.

The US AID market welcomed a new competitor in May when FDA granted 510(k) clearance for Beta Bionics’ first commercial AID, the iLet Bionic Pancreas, approved for T1s age six and up. iLet is the least burdensome tubed AID to hit the market to date, and it could be a game changer for some users. The system employs an adaptive closed-loop algorithm and the only input required to start the device is the user’s body weight. Unlike other AIDs, there are no dosing parameters to input or settings to manually adjust. Moreover, it replaces conventional carb counting with a new meal announcement feature that allows users to designate their meal simply as small, medium, or large. The system, which is currently paired with Dexcom’s G6 CGM, learns each user’s individual insulin needs and 100% of insulin doses are fully automated, eliminating manual correction boluses.

Although Insulet may be the only US insulin pump competitor currently experiencing above-market growth, with pump penetration rates still fairly low—less than 40% of people in the US with T1D and only 5-6% of intensive insulin users with T2D currently use a pump or AID—and a diverse and expanding diabetes patient population worldwide, there’s likely to be more growth ahead, and plenty of opportunity to go around.

Read the full story here.